Yes, life insurance is worth it for many people. It provides financial security for your loved ones in case something happens to you.

Life insurance can seem complicated and unnecessary to some. But its value goes beyond just a policy. It offers peace of mind and a safety net for your family. Imagine leaving your family with no financial support. This can add stress during an already difficult time.

Life insurance ensures they have funds for daily expenses, debts, or future plans. This blog post will explore why life insurance is a smart choice. We’ll look at its benefits and help you decide if it fits your needs. Stay with us to understand the true worth of life insurance.

Introduction To Life Insurance

Life insurance can seem confusing. Many people wonder if it’s necessary. Let’s break down the basics of life insurance. We will explore its purpose and address common misconceptions. This will help you understand why life insurance may be worth considering.

Purpose And Basics

Life insurance provides financial protection. It helps families manage after a loved one’s death. The policyholder pays regular premiums. In return, the insurer pays a death benefit to the beneficiaries. This money can cover funeral costs, debts, and living expenses. It can also help maintain the family’s lifestyle. There are two main types of life insurance: term and whole. Term life insurance covers a specific period. It is usually cheaper. Whole life insurance covers the policyholder’s entire life. It also has a cash value component. Both types have their benefits.

Common Misconceptions

Many people believe life insurance is only for the elderly. This is not true. It can benefit people of all ages. Another myth is that life insurance is too expensive. In reality, term life insurance can be affordable. Some think they don’t need it because they are healthy. But accidents and unexpected illnesses can happen to anyone. Others assume employer-provided life insurance is enough. Often, it may not cover all needs. Another misconception is that life insurance is only for those with dependents. It can also cover final expenses and debts, easing the burden on loved ones. Understanding these misconceptions helps in making informed decisions about life insurance.

Types Of Life Insurance

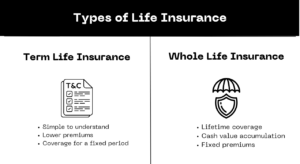

Choosing the right life insurance can be a complex decision. There are various types to consider, each with its benefits and drawbacks. Understanding the different options can help you make an informed choice that suits your needs. Here, we will cover two main types: Term Life Insurance and Whole Life Insurance.

Term Life Insurance

Term Life Insurance offers coverage for a specific period. You choose the term, typically between 10 to 30 years. If you die during this term, the policy pays out to your beneficiaries. This type of insurance is often more affordable than whole life insurance.

- Simple to understand

- Lower premiums

- Coverage for a fixed period

Term life insurance is best for those who need coverage for a specific time frame. For example, while paying off a mortgage or supporting children until they become independent.

| Pros | Cons |

| Lower cost | No cash value |

| Flexible terms | Premiums can increase after term ends |

Whole Life Insurance

Whole Life Insurance provides coverage for your entire life. It also includes a savings component, called cash value, which grows over time. This cash value can be borrowed against or withdrawn.

- Lifetime coverage

- Cash value accumulation

- Fixed premiums

Whole life insurance can be more expensive but offers more benefits. It is suitable for those wanting lifelong coverage and an investment component.

| Pros | Cons |

| Lifetime protection | Higher premiums |

| Builds cash value | Complex structure |

Financial Security For Loved Ones

Life insurance can provide essential financial security for loved ones. It ensures they are taken care of during difficult times. By having life insurance, families can have peace of mind. They know their financial future is protected.

Income Replacement

If the main earner in a family passes away, life insurance helps. It replaces the lost income. This allows the family to maintain their standard of living. They can cover daily expenses like groceries, utilities, and education. This support is crucial for a stable future.

Debt Coverage

Life insurance also helps with debt coverage. If a person dies, their debts do not go away. Families are left to handle these financial burdens. Life insurance can pay off these debts. This includes mortgages, car loans, and credit card bills. It prevents the family from facing financial hardships.

Living Benefits

Many people think of life insurance as a safety net for their loved ones after they pass away. But did you know life insurance also offers living benefits? These benefits allow policyholders to access funds while they’re still alive. This can be a financial lifeline in times of need.

Access To Cash Value

Permanent life insurance policies, like whole life or universal life, build cash value over time. This cash value grows tax-deferred. You can access it at any time. It’s like having a savings account that you can tap into. Need money for an emergency? You can withdraw from the cash value. Want to invest in a new business venture? Use the cash value for that too. The best part? You don’t pay taxes on the money you withdraw, as long as it doesn’t exceed the amount you’ve paid in premiums.

Loans Against Policy

Another living benefit is the ability to take out loans against your policy. This works much like borrowing from a bank, but it’s often easier and quicker. You can borrow up to the amount of the cash value of your policy. Policy loans can be used for any purpose. You might need to cover medical bills, pay off high-interest debt, or fund a child’s education. The interest rates are usually lower than those of personal loans or credit cards. Remember, if you don’t repay the loan, it will reduce the death benefit. But having this option can provide peace of mind and financial flexibility.

Tax Advantages

Life insurance provides several tax advantages that can make it a smart financial choice. These benefits can help you and your loved ones save money. They can also provide financial security for your family. Let’s explore some of these tax advantages.

Tax-free Death Benefit

One of the key benefits of life insurance is the tax-free death benefit. The money your beneficiaries receive is usually not taxed. This means they get the full amount of the policy. This can be a huge relief during tough times. It can help cover expenses like funeral costs, debts, and living expenses.

Tax-deferred Growth

With some life insurance policies, your cash value grows tax-deferred. This means you do not pay taxes on the earnings each year. The cash value can grow over time without being reduced by taxes. This can provide a larger amount of money in the future. You can use this money for various needs, like retirement or emergencies.

Supplementing Retirement Income

Supplementing Retirement Income is a key consideration for many approaching their golden years. Life insurance can play a crucial role in this aspect. It offers financial security and peace of mind for retirees. Let’s explore how life insurance can supplement your retirement income.

Annuities And Payouts

Life insurance policies can provide annuities which are regular payments. These are helpful during retirement. They offer a steady income stream, ensuring financial stability. There are various types of annuities:

- Fixed Annuities: Provide guaranteed payouts at regular intervals.

- Variable Annuities: Payments vary based on investment performance.

- Immediate Annuities: Start payouts right after a lump sum payment.

- Deferred Annuities: Payments begin after a certain period.

Each type has its benefits. Fixed annuities offer predictability. Variable annuities provide growth potential. Immediate annuities cater to those needing quick income. Deferred annuities are suitable for future needs.

Long-term Care Coverage

Some life insurance policies include long-term care coverage. This can be vital during retirement. It helps cover costs for assisted living, nursing homes, or in-home care. Long-term care coverage ensures:

- Reduced financial burden on family members.

- Access to quality care facilities.

- Peace of mind knowing you are covered.

Without this coverage, long-term care can be expensive. Many retirees use their savings to cover these costs. This can quickly deplete their funds. Having life insurance with long-term care can prevent this issue. Here is a quick comparison of the benefits:

| Benefit | Description |

| Annuities | Provide regular income streams. |

| Long-Term Care Coverage | Helps with healthcare costs. |

Peace Of Mind

Life insurance provides a sense of security. Knowing your loved ones are protected helps you relax. It can make a big difference in your daily stress levels. This peace of mind is priceless.

Stress Reduction

Stress can affect health and happiness. Life insurance can reduce this stress. You know your family will be financially secure. This assurance can lower anxiety and improve your mental health. Here are some ways life insurance reduces stress:

- Covering funeral costs

- Paying off debts

- Providing for children’s education

- Maintaining living standards

These benefits ensure your family won’t struggle financially. This reduces your stress significantly.

Future Planning

Life insurance helps with future planning. It provides a financial cushion for your family. This support is crucial if you are the primary earner. Your family can continue their lives without major financial changes. Future planning with life insurance includes:

- Setting up a trust for children

- Ensuring a steady income stream

- Covering long-term care costs

- Leaving an inheritance

These plans give your family a clear roadmap. They will know what to expect and how to manage finances.

Evaluating Your Needs

Evaluating your needs is a crucial step in deciding on life insurance. It helps you understand what type of coverage suits you best. This ensures you and your loved ones are protected. Let’s dive into some key aspects.

Assessing Coverage Amount

First, consider how much coverage you need. Think about your family’s financial needs. This includes daily expenses, mortgage payments, and children’s education costs. Also, consider debts and final expenses. A good rule is to aim for coverage that equals 10 times your annual income. Another factor is future expenses. Will your family need extra support? Calculate these amounts to get a clear picture. This helps in deciding the right coverage amount.

Choosing The Right Policy

Next, decide on the type of policy. There are two main types: term life and whole life. Term life insurance covers you for a set period. It is usually cheaper and simpler. Whole life insurance covers you for your entire life. It includes a savings component but is more expensive. Think about your budget and long-term goals. Term life is good if you need coverage for a specific time. Whole life is better if you want lifelong coverage and savings. Choose the one that aligns with your needs.

Conclusion

Life insurance provides financial security for loved ones. It’s a valuable investment. Consider your family’s needs and future. Evaluate your budget and coverage options. Peace of mind comes from knowing they are protected. Life insurance can be a smart choice.

It helps in unexpected times. Think about it carefully. Consult with an expert if unsure. Making the right decision matters. Your family’s future depends on it.

Faqs about life Insurance

1. Is it really good to have life insurance?

Yes, having life insurance is highly beneficial as it provides financial security to your loved ones in case of your untimely demise. It helps cover debts, living expenses, and future needs like education or retirement.

2. Is it a good idea to take out life insurance?

Taking out life insurance is a smart decision, especially if you have dependents. It ensures they won’t face financial difficulties, covering expenses like loans, mortgages, and daily living costs.

3. Is it better to save or have life insurance?

Both are important, but life insurance protects your family financially after your death, while savings are for personal use during your lifetime. A combination of both ensures a secure financial future.

4. Is life insurance worth it for a single person?

Life insurance can still be worth it for single individuals. It can help cover debts, funeral costs, or leave a financial legacy for loved ones or charities.

5. Is life insurance worth it in your 20s?

Yes, life insurance is worth it in your 20s. Premiums are usually lower when you’re young and healthy, and it’s a great way to secure long-term financial protection at an affordable cost.

6. Reasons not to buy life insurance

- If you have no dependents or debts.

- If your savings and assets are sufficient to cover expenses.

- If you’re unable to afford premiums without straining your budget.

Pingback: Can I Use Life Insurance to Buy a House? Yes, But…

Pingback: Can You Have Life Insurance while on Medicaid in Missouri